Lease with Option to Buy

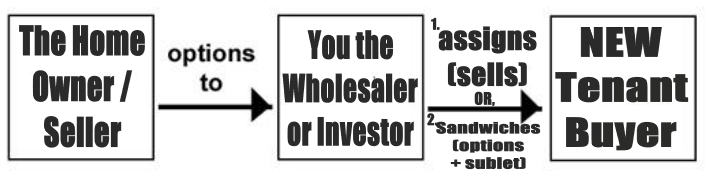

Buying a property using a lease option as an investor involves leasing the property with an option to purchase at a set price within a specific time. This arrangement offers flexibility to evaluate and potentially profit from the property. Investors can also sell this option to a tenant buyer through an assignment or act as intermediaries, collecting profits from the monthly rent in a "sandwich lease option" scenario.

Here's an example Acquiring a Property Using Lease Purchase Option:

Property Details:

Purchase price of the home: $300,000

Lease Purchase Transaction:

The buyer and seller agree that the buyer will lease the property for a specified term with the option to purchase.

The term of the lease purchase is set for 12 months.

Down Payment and Lease Terms:

The buyer provides a down payment of $5,000 to the seller.

The buyer and seller agree on the monthly lease payment.

Lease Period:

The buyer takes possession of the property and becomes the tenant.

The buyer pays the agreed-upon monthly lease amount to the seller/landlord.

The buyer is responsible for maintaining the property and paying for utilities and other applicable expenses.

Option to Purchase:

The lease agreement includes an option for the buyer to purchase the property at the end of the lease term.

The terms of the purchase, such as the purchase price and financing arrangements, are outlined in the agreement.

Purchase Decision:

At the end of the 12-month lease term, the buyer has the option to exercise their right to purchase the property.

If the buyer chooses to proceed with the purchase, the necessary steps for closing and transferring ownership are initiated.

HOW DO YOU ASK THE HOMEOWNER?

✔ ASK THIS QUESTION TO SEE IF THIS "LEASE PURCHASE OPTION" STRATEGY FITS THE HOMEOWNER LEAD YOU'RE TALKING TO:

"Mr. Home Owner, would you allow us a ____ month (12 or more) lease, if we cover your monthly payment, handle all maintenance, and close ASAP?"

✔ You'll Know This Strategy Fits If The Homeowner Says:

"I’d be open to renting the property for now, with the option to sell later."

"I don’t need to sell right away, but I’d like to generate some income in the meantime."

"I’m having trouble selling the house right now, so maybe leasing it would work."

"I’d like to lock in a sale price now but give the buyer some time to complete the purchase."

"I’m not in a rush to move, but I’d like to keep my options open for a sale."

Best For:

Sellers who are willing to lease the property for a period of time while offering the buyer an option to purchase later.

Sellers looking for rental income while waiting for a buyer to qualify for financing or prepare for the purchase.

Homeowners who are having difficulty selling in the current market but want to lock in a potential sale.

Download My Proprietary Lease Purchase Agreement Here

_

Turn Your New Deal Into Money: Sell/Assign OR Sandwich/Sublet Your Acquired Contracted Property Deal

INVESTOR EXIT STRATEGY OPTION 1: Sell / Assign Your Contracted Property Deal to a New Tenant Buyer for an Assignment Fee.

(Goal: $15,000 profit)

TOOL: My Advanced Assignment

Agreement for Wholesaling a Lease Option Deal

(Assigning to a New Tenant Buyer but Still Create Passive Income)

The wholesaler/investor strategically promotes their "Rent to Own" agreement on online platforms, successfully attracting a prospective tenant/buyer. This individual is willing to adhere to the terms outlined in the investor's agreement with the original seller and is prepared to compensate the investor with an "Assignment Fee" for the privilege of assuming the contract. Notably, Justin consistently earns an average Assignment Fee of $15,000.00 per deal. Justin finances the assignment fee in a unique way in order to create passive income, even though he is assigning his position in the deal and walking away.

INVESTOR EXIT STRATEGY OPTION 2:

Sandwich / Sublet Lease Option

(Goal: $15,000 Upfront Profit + $500/Month Profit + $45,000 Backend Profit)

3 Profit Centers in a Sandwich Lease Option Transaction

The investor will stay in the middle as the "Meat" in the sandwich. This will create 3 profit centers after the investor has found a worthy end Tenant/Buyer.

In a sandwich lease option transaction, investors can benefit from three primary profit centers:

1. Upfront Option Fee: (ex: $15,000 to investor)

Investors collect an upfront option fee from the end tenant buyer.

This fee serves as a non-refundable down payment, granting the buyer the right to purchase the property within a specified period.

The upfront fee provides immediate income to the investor.

2. Monthly Rental Spread: (ex: $500/month to Investor)

Investors profit from the difference between the monthly lease payment made to the homeowner (seller) and the higher monthly lease payment received from the end tenant buyer.

The rental spread represents a consistent source of monthly income for the investor throughout the lease option period.

3. Equity Growth: (ex: $45,000 to investor when new tenant buyer finances & purchases the house)

Investors negotiate the purchase price with the homeowner (seller) at the beginning of the lease option agreement.

If the property appreciates in value during the lease option period, the investor can benefit from the equity growth.

The difference between the initial purchase price and the current market value represents the investor's potential equity profit.

These three profit centers make sandwich lease option transactions an attractive investment strategy, offering income and potential gains from property appreciation, while providing a beneficial solution for the homeowner and the end tenant buyer.